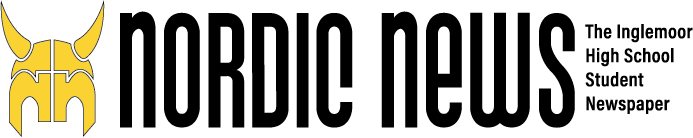

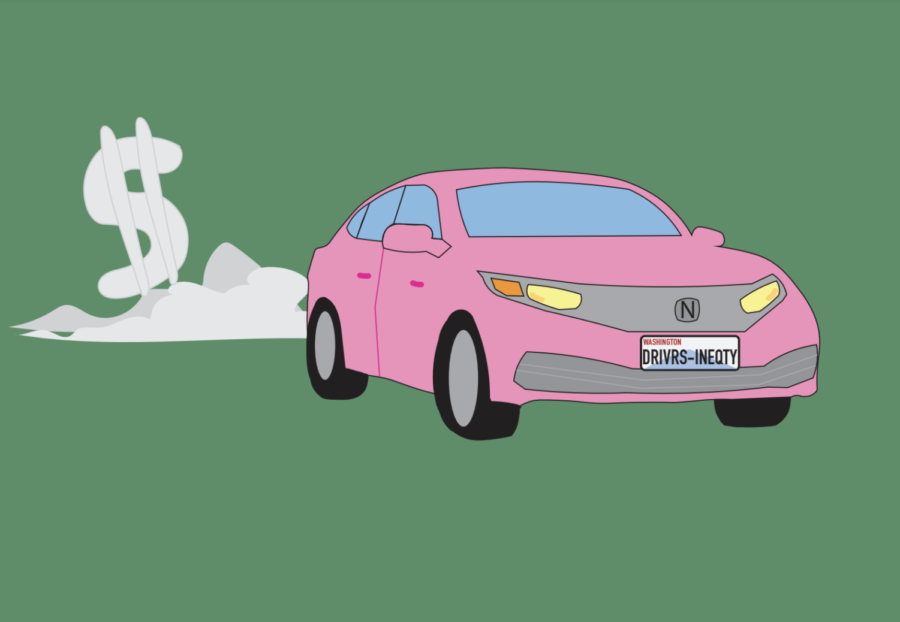

On March 5, an op-ed calling for a government stimulus package of $350 million and stimulus checks of $1,000 to most Americans was published in the Wall Street Journal. As businesses, schools and public places were forced to close in the following weeks in response to the pandemic, such a solution became increasingly appealing as a viable way to both provide relief to families out of work and to revive a slumping economy. On March 27, the CARES Act was passed by Congress and will give adults who reported an income of $75,000 or less a check for $1,200. Couples will receive double the amount, and families with children will receive an additional $500 dollars for each child under 17. Although the checks provide necessary aid to families in need, the issues posed by a declining economy need a more permanent solution to address the underlying problems caused by the pandemic.

One-time payments of $1,200 are simply not enough to meet the financial needs of Americans affected by the economic crisis. According to CBS news, many recipients have noted that the checks do not adequately cover their basic living costs, even for just one month. Furthermore, experts working for Oxford Economics have predicted that the recession will be more prolonged and pervasive than initially believed to be, making the stimulus checks essentially ineffective for any situation past the short-term. The degree of relief provided by these checks alone is simply not enough considering the current situation.

Stimulus checks have also been criticized in relation to actually reviving the economy, since the inability to conduct face-to-face business and industry cannot be fixed by simply giving out money. Moreover, the amount provided to struggling families, although beneficial, will most likely be used toward utilities and necessities such as food. Businesses considered non-essential— clothing stores, salons, etc. — and hit the hardest by the pandemic, will not be saved by these checks. The amount allocated by the checks themselves is not enough to help families or the economy.

Noting the failure of the checks to even reach all families in need due to flaws in the mailing system and the absence of bank accounts for many low-income citizens, the United States government needs to consider finding more sustainable solutions to be used in tangent with stimulus checks. Experts are currently looking to the already-established unemployment insurance system, which can get money to people quicker and represent a long-term answer to alleviating the burden of the crisis. However, programs are currently unable to handle the higher volumes of people in need and are buckling under the strain. Government actions to strengthen the system—in terms of capacity and accessibility of unemployment aid—would reach a far greater number of people. Although some states have already begun to distribute extra funds to unemployed workers, the $600 federal benefit still fails to reach many Americans, such as the self-employed. Other options, such as placing more funds into the cards of food stamp recipients could also be a way to reduce economic pressure. Such methods need to be implemented in conjunction with stimulus checks to truly help those out of a job.

Considering these factors and the diversity of situations currently faced by Americans, stimulus checks are a band-aid solution to a bullet-hole problem and are not the cure-all for families in need. Rather, there should be more government action to improve and adapt existing programs for low-income families in order to reach more people and effectively ease the economic burden. No amount of money can fix the fundamental problems causing the recession, but in the meantime, the country can and needs to work on helping its citizens.