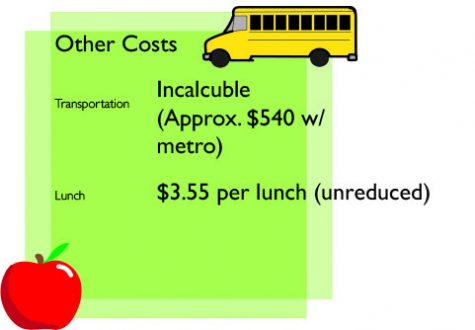

Those between 8 and 18 years old in Washington state are required by law to regularly attend school. Public schools, including Inglemoor, are funded by taxes, which allow children to receive school services without directly paying for them. However, while instruction itself at Inglemoor is free, there are other costs not covered by taxpayers that students and their families must account for.

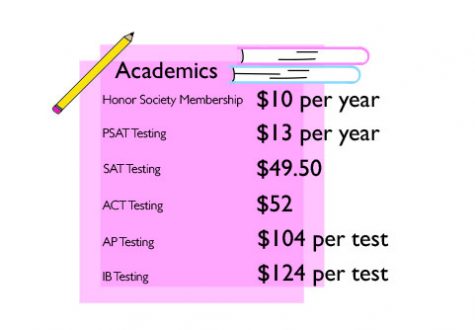

The extra costs most commonly encountered are those directly in the path of instruction and schoolwide activities. Almost all freshmen, sophomores and juniors pay $13 each time they take the PSAT, but especially major expenses fall upon juniors and seniors who pay around $124 per IB test or $104 per AP test. Many students pay for ASB membership and a yearbook every year, totaling almost $500 over the course of their high school career. Seniors must foot the cost of a graduation cap and gown, and if they hope to attend the senior breakfast or party, they must pay more. Seniors wishing to attend college must pay for applications, too; in the United States, each one costs on average $43.

Student expenditures increase further when extracurriculars are taken into account. Clubs and sports are a large part of the school experience for many students, but in order to participate, they need to pay. In order to play a sport at Inglemoor, one must be an ASB member and pay an additional $154 per sport per year with a maximum of $308 per year if participating in multiple sports. If a student wants to attend a sporting event and show school spirit, they must pay up to $7 per game, depending on ASB membership. Many competition clubs travel; DECA alone can cost around $1500 per year. Participating in Honor Society is an additional expense.

As students work their way through high school, expenses build quickly; spirit gear, band uniforms and field trips are just a few more costs students must manage. For the students who transferred for IB, transportation costs can build up; a ride on the public bus can cost around $540 per year for a daily roundtrip. Across four years, costs quickly mount for students and families who wish to participate in any school-related activities. These expenses show that a free public education is effectively not even close.

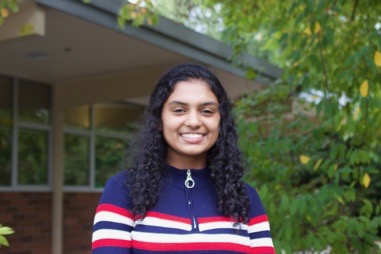

Students identify stigma around financial help

Last year, senior Maile Hodge said she was invited to go on a trip to Disneyland for choir. However, either because of the lack of scholarships that were available or the lack of knowledge of these scholarships, she and many of her peers were unable to go.

“There were big payments…It didn’t feel good knowing that my friends were off in California having fun, but I could not go because of my financial situation,” Hodge said. “I was just so embarrassed.”

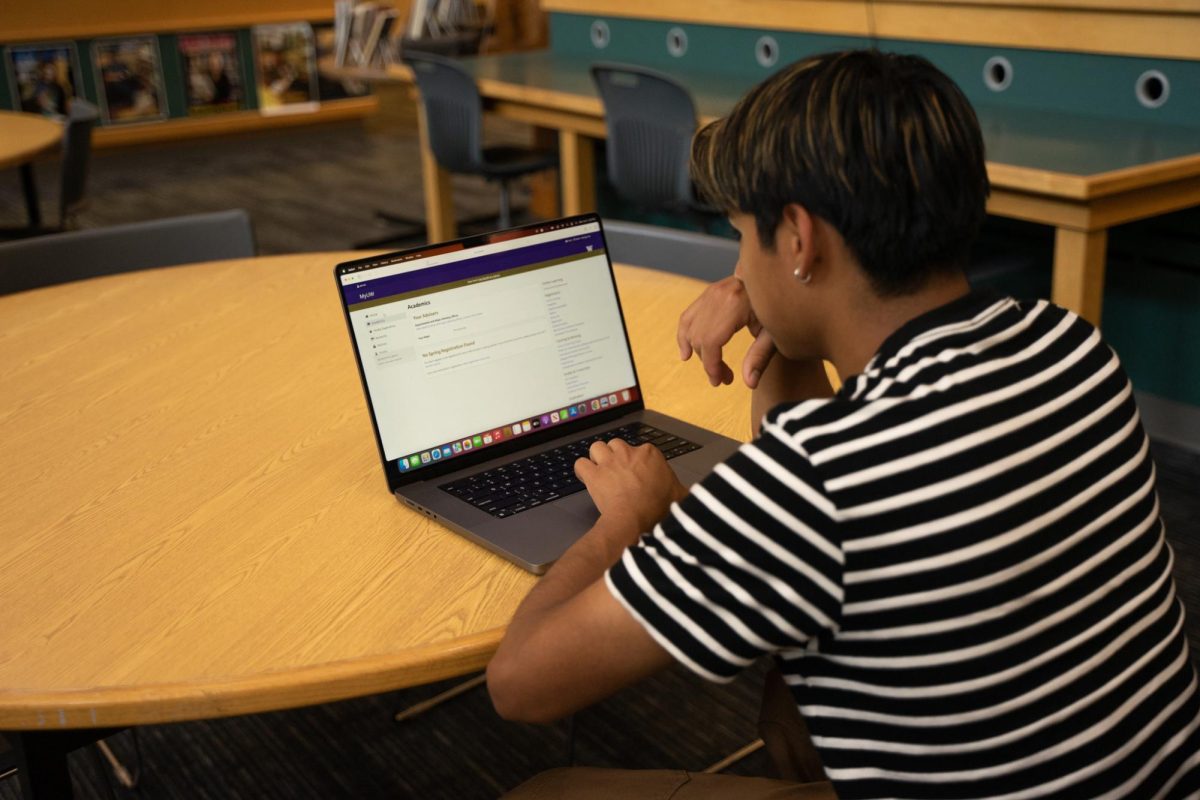

Now that Hodge knows the financial assistance is available, she said the process to get it has been fairly easy; she has received financial aid for IB and AP tests, class fees and field trips. However, she said she feels awkward asking her counselor for help sometimes because she feels like she is being a burden.

“I felt embarrassed in a way because I kind of feel that there are people in worse situations than I am,” Hodge said. “Why should I have to ask for help? Am I wasting the school’s money?”

Her feelings of shame, she said, can be attributed to not having a lot of money growing up, which has made her reluctant to ask for financial aid.

“I’ve always been kind of embarrassed to talk about my financial situation in the first place…It just made me feel somewhat embarrassed that I don’t have the money for these things,” Hodge said. “Why can’t I be normal like a lot of other people who can just do these things without having to ask for help?”

Junior Marianne Villamil said she has noticed a stigma around getting financial help, where people automatically assume the worst-case scenario.

“But there are varied reasons to get aid, and it’s just not one thing. Like you might have like four siblings going to high school different years. And it’s, you know, hard to pay for when they want to do sports, and they want to do other things,” Villamil said.

In order to make the process less humiliating, sophomore **change name** said more information about what the scholarships entail would be beneficial. Hodge also said she would like to see more information available to students for how they can get help; she said she wants an environment in the counseling office that is more welcoming to accomodate students’ financial needs.

“[I want] an encouraging environment, [where] it’s okay to talk about that stuff,” Hodge said. “[One that says] ‘we’re not gonna judge you. We’re here to help.’”

Resources for students

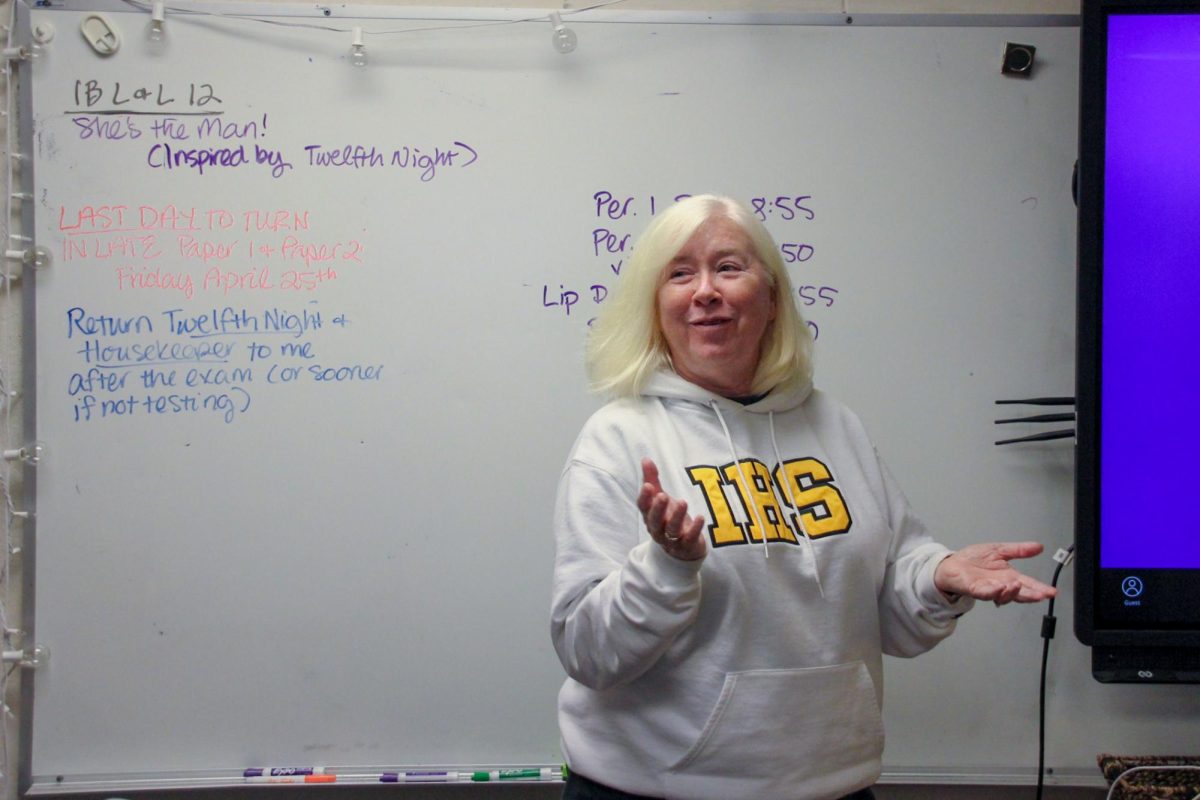

Every year, a nonprofit called InvestED gives Inglemoor a grant of about $1000 and matches up to an additional $500 that is donated by staff and community members. While bookkeeper Sarah Kiel said she didn’t want to provide a specific numerical value to the school’s resources, she said the school is in a good place.

“The Northshore Schools Foundation is kind of piloting [investED with the nonprofit] to see if we [can] really start helping kids with all the foreseeable needs that [they may have]. They’re at a place where they can keep funneling money to us. So right now, there’s money available,” Kiel said.

Starting this year, the school has received donations from the Northshore Schools Foundation, teachers and parents that have gone into the InvestED account for the counselors to manage.

“[InvestED] is a statewide program that helps offset costs for students who need financial assistance for school fees. Basically, if any student has a financial need for literally anything, we can help… If they need an eye exam to get glasses, if they need transportation, like a bus pass, or if they need, you know, a new winter coat or help going on a field trip or anything like that,” Kiel said.

Counselors limit financial aid for each student to roughly $250 to ensure that they help as many students as possible. According to Kiel, priority is given to students on free and reduced lunch; however, there is money available for any student who needs assistance but is not on the list.

“Right now, our workflow is if a student has a financial need, they should go to their counselor and the counselors are the ones who are helping divvy out how that money is spent,” Kiel said. “It’s kind of evaluated on a case by case basis.”

While the money from the InvestED account can be used for anything a student might need, scholarships from ASB and the district are restricted to school-related fees.

“We just can’t gift public funds to people, so anything that a student would keep,” Kiel said, “we can’t use ASB or district money for because that money comes from taxpayers.”