High school doesn’t teach students the material that is needed to survive after graduation. As soon as a student turns eighteen-years-old and graduates from high school, they are — more likely than not — thrown into a pile of financial responsibilities that they have no clue how to sort through. According to the National Financial Educators’ Council, high school students in the United States in 2021 scored an average score of 63.5% on a basic financial literacy test. High schoolers need to be educated about personal finances. Students are woefully underprepared for real life responsibilities like paying rent, taking out loans and managing their own bank accounts when they become adults. That is simply unacceptable.

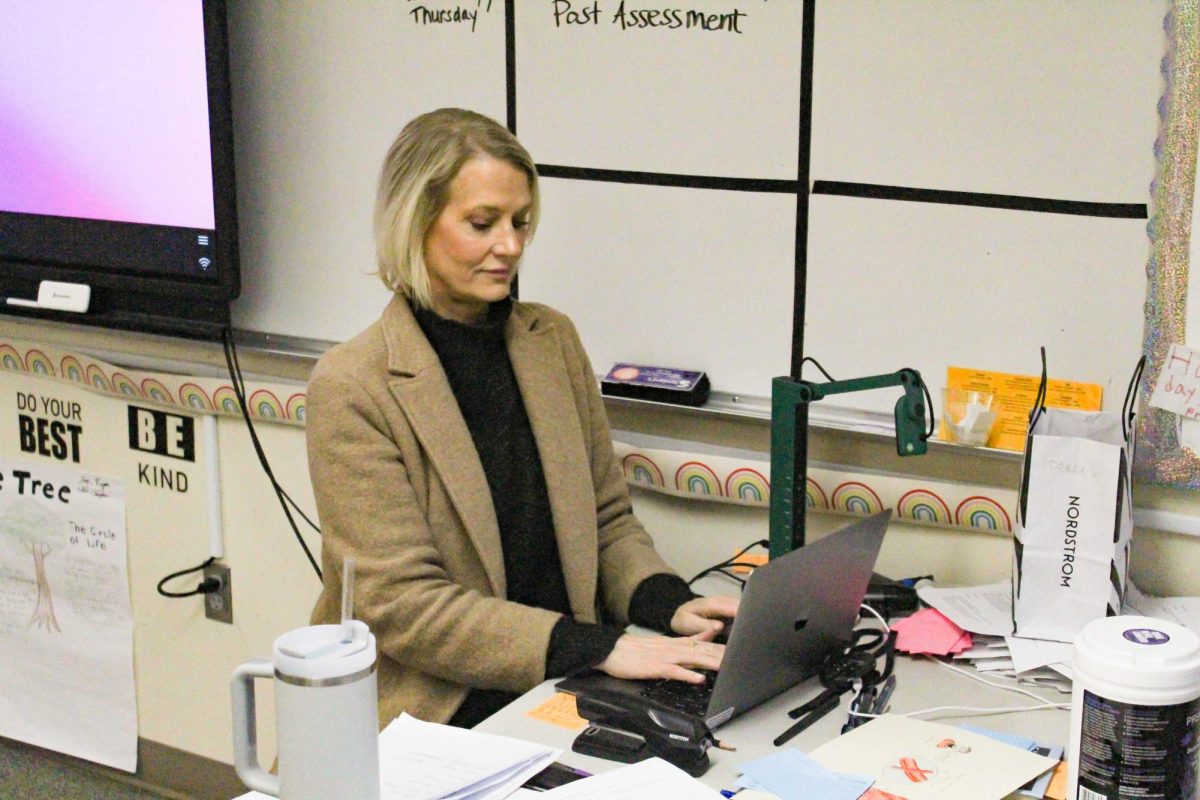

While Inglemoor does offer courses in finance, K-12 students are not required to take financial literacy courses in Washington State. Many students do not take the courses Inglemoor offers because they have to meet other graduation requirements or want to take other, more interesting courses. Students are less likely to learn skills that are essential to their financial well being because they are not required to. At the very least, Inglemoor should require students to attend an assembly where they can learn the basics of financial literacy.

A 2018 study published by the University of Illinois found that nearly a third of young adults were in a financially precarious position because they did not receive sufficient financial literacy education. Financial literacy courses would guide students in building stable financial statuses by teaching them about credit and the banking system. Credit scores impact an individual’s ability to take out loans and rent or buy apartments and houses. Those who pursue higher education may also have to contend with loans and may end up in debt after they finish college. College debt extends the amount of time that graduates are stuck in that financially precarious position and impacts their financial credibility.

According to the Education Data Initiative, the total amount of student debt in the US is $1.762 trillion as of this year. Crippling student debt not only starts graduates off on the wrong foot financially, it also accumulates over time and becomes unmanageable.

The lack of financial literacy education in high schools means that graduates have to learn how to navigate the many sectors of the economy on their own. This is why Inglemoor needs to be teaching students how to navigate the financial world before they are thrown into it headfirst.

A CNBC article from January 2021 reported that 18% of Americans are unable to pay rent. The AARP reported that almost half of Americans over age 55 do not have retirement savings. We need to combat these numbers by teaching students how to manage their money early on. If we are required to learn about global disasters like the Great Depression, we should be taught how to react in times of economic uncertainty.

Financial literacy should be a graduation requirement, whether it is taught within one of our core classes — like history — or as a separate course. This would prepare students for real life and leave them with the prospect of a stable economic future after high school, regardless of the path they take.