Inglemoor has a number of business related clubs and classes where students can learn financial literacy — a subject that covers personal finances, budgeting or investing. 85% of students are interested in learning about financial topics in school like saving and investing, a 2024 Intuit study says. Senior Kairui Cheng (he/him) said he began learning about the latter in August 2024 when he invested in Intel Corporation shares. Shares represent ownership of a company, and their prices fluctuate based on supply, demand and company perception. Following the resignation of then-CEO Patrick Gelsinger, Cheng sold his shares for an estimated 20% profit.

People can profit from trading stocks by selling their stocks at a higher stock price. By trading stocks, investors can make a profit to supplement their main income sources. Cheng said that he began to learn about trading to deepen his understanding of the economy and work towards financial freedom for the future.

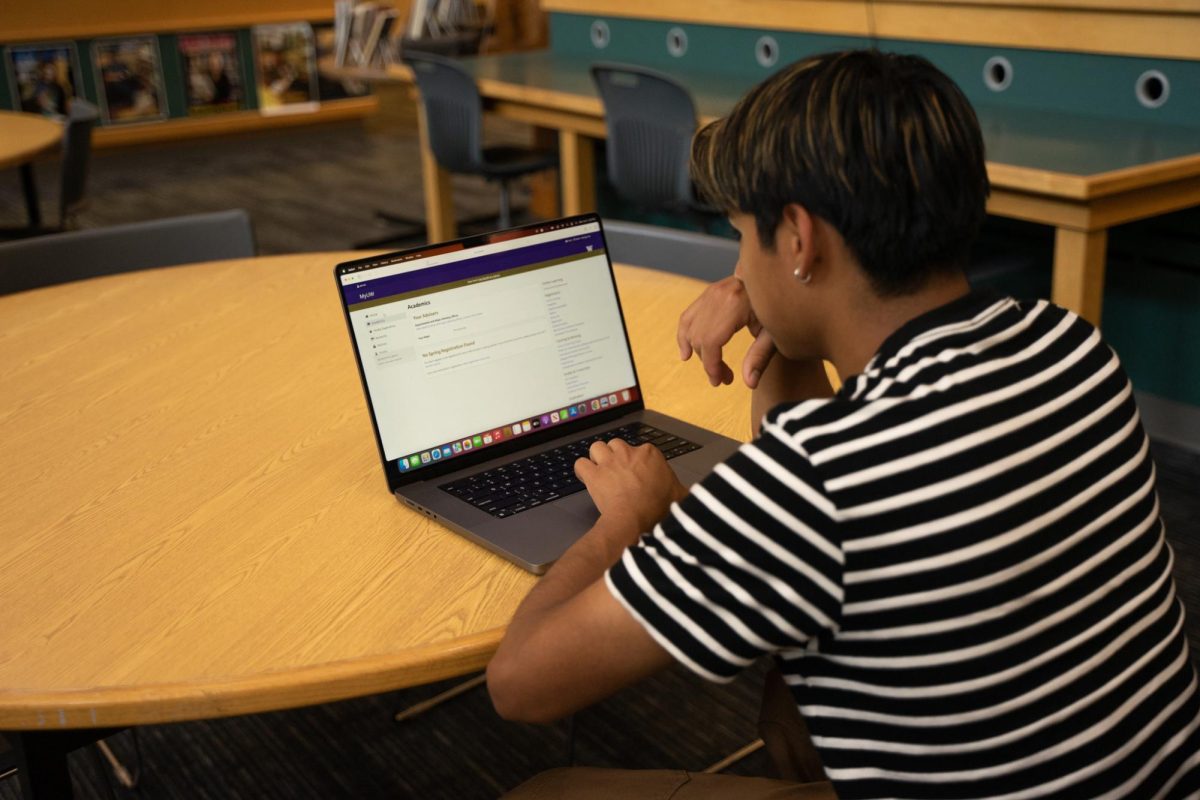

“I just wanted to learn a little bit about finance, but I also wanted to start building these habits because I think they’ll be really useful for me in the future,” Cheng said. “Especially when I get a more high paying job, because I can start investing my money and focusing more on financial freedom.”

Junior Rylan Cranmore’s (he/him) friend first introduced him to trading and making passive income. He found resources to learn about trading on YouTube, educational courses from investment companies and organizations like Charles Schwab and the Stock Market Game.

“There’s this thing called paper trading, which is trading with fake money. You can learn a lot just by trial and error, figuring things out,” Cranmore said.

Trading simulations, more commonly known as “paper trading,” allow investors to practice buying and selling stocks without the risk of using real money. The Stock Market Game is an online stock market economy simulation that challenges players to maximize profit from five different stocks and bonds over five rounds. Cranmore said that through this practice, he has learned that trading and investing, even in a cautious manner, could yield better returns than just leaving money in a bank account earning minimal interest. The S&P 500 — a stock index that tracks the average stock performance of the 500 largest companies listed on stock exchanges in the United States — generates an average 10% return on investments. The national average annual percentage rate (APR), in comparison, is 0.43%, according to the Federal Deposit Insurance Corporation.

“Money just sitting in a bank is not a good idea, right?” Cranmore said. “You’re making very minimal interest. But if you just invest it in a stable market, you’re going to get steady growth that’s going to outperform any bank. That’s why almost everyone has retirement funds in stock portfolios — because you’re going to make more money. Even trading very cautiously, you’re going to make more money than you are in banking.”

Cheng said that in the long term, he hopes to use his stock portfolio as a second, passive income stream to gain more financial security. He said he follows F.I.R.E., a financial movement that originated online and has recently been regaining popularity.

“Basically with F.I.R.E., you can work at a specific job but not need to worry about the financial constraints that you have, so you can do what you enjoy and not be burdened by the monetary concerns that your finances could have.”

Cheng said understanding financial literacy and how the market works is an important skill. He said that they are steps toward economic independence and that more people should understand stock trading to become self-sufficient.

“I think it’s good for everyone to learn how the market works because it influences how you manage your money and how you save the rest. Those are skills that would benefit many Americans in their pursuit for a better life,” Cheng said.

Starting investors face many challenges when entering the market, Cranmore said.

“You’re not going to see major gains in the stock market unless you have a lot of capital — a lot of money — right?” Cranmore said.

Systemic barriers like generational wealth and knowledge can be discouraging to new investors, Cranmore said. He also said that generational experiences and accessibility to resources can also be discouraging to new investors.

“Being able to learn from the experiences of the past — like the generations of your parents — I think that’s also really valuable insight into how you’re going to manage these types of decisions in the future,” Cheng said. “People in poverty — they do not have the means. Their parents don’t have the means to access these different markets or resources simply from a lack of experience, or they lack resources and generational knowledge.”

Cheng is optimistic about how long-term investing will go and believes that, through stock trading and investing, more people will be able to achieve financial independence and gain a more unconfined life.

“Being unshackled from the different financial constraints that we have — needing to have a job to continuously generate income stream, not having the requirement of working for an employer or working for someone, for sustenance, for living — I think that’s a really powerful and empowering feeling that allows for a lot of freedom. You have more freedom to decide what you want to do every day,” Cheng said.