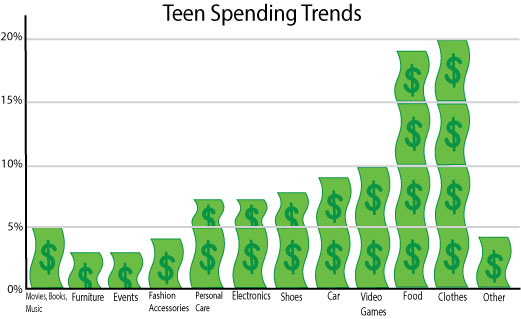

The high school years are when most students begin learning how to balance their spending across their numerous needs, wants and values. According to the National Endowment for Education, 1 in 5 U.S. teenage students lack basic financial literacy skills. Financial independence gives teens the freedom to spend their money as they please. When students get their first job, earning a steady income can often entice them to spend on items they don’t necessarily need.

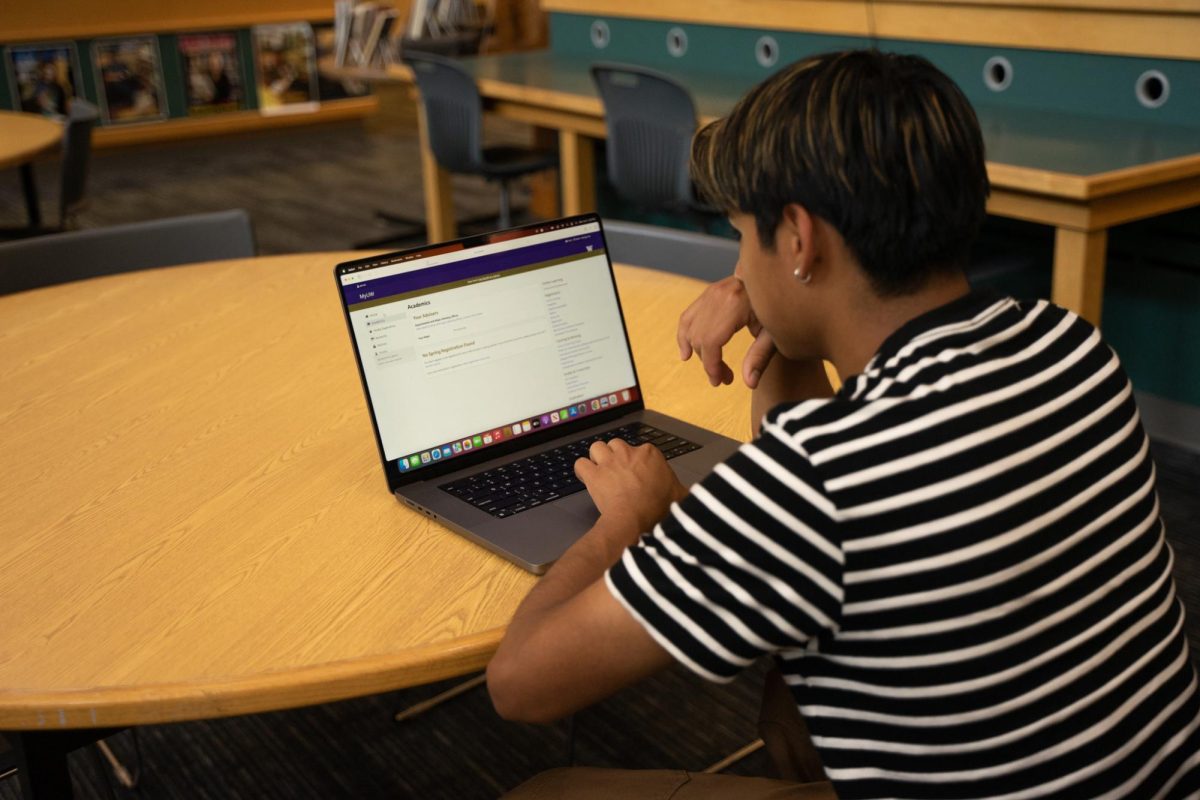

Senior Natalia Canal (she/her) has been working as a hostess for three years. Canal said that working overtime and managing her income has enabled her to be more carefree with spending.

“I think sometimes when I do lose track of the exact number that’s going on, I find it easier to just spend without really thinking about it,” Canal said.

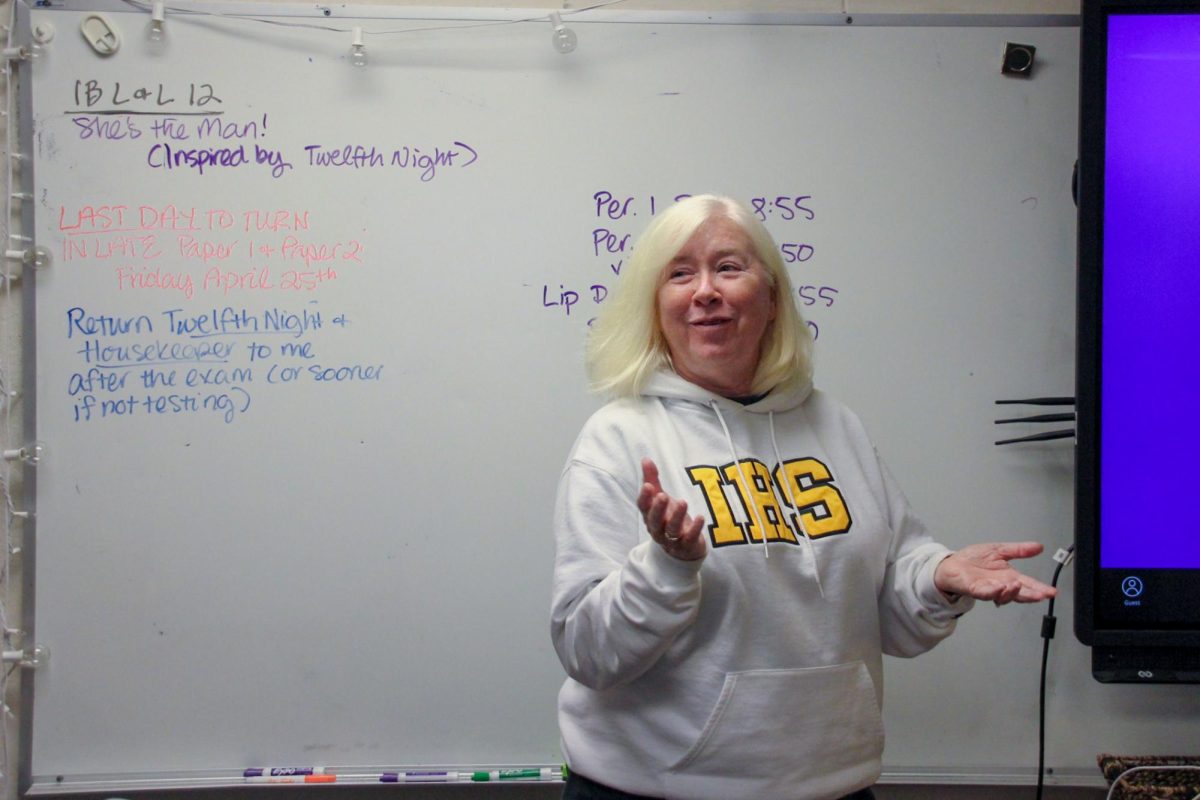

Finance teacher Amanda Ellis (she/her) has taught financial literacy for two years. Ellis said a common mistake students make is failing to consider the benefits of saving their money fast and early. She recommends that students follow the 50-30-20 rule, a budget strategy that puts 50% of money towards needs, 30% towards wants and 20% towards savings. This approach is effective for planning ahead and efficiently organizing finances.

Ellis also stressed the importance of compound interest to help teens progressively make more money. Compound interest refers to continuously earning interest on saved money, which is why Ellis said it’s so important to start saving young.

Canal receives her income in cash only and as a result, organizes her money in piles. The groups consist of cash she designates to spend for the week, and two other separate stacks of savings — one she can use and the other that she leaves alone.

“I think I used to be a lot more stingy, especially when it came to my spending-savings. That’s what I call it. Two sets of savings. But I think I kind of noticed, if I do have that first set of savings, I don’t feel like I need to be super stingy with the money I do allow myself to spend because I am supposedly allowing myself to spend that money. So I shouldn’t feel bad.” Canal said.

Similarly, junior Bobae Park (she/her) works at Alexis Cafe and said that having a job has taught her to manage her spending by using money-management strategies.

“I try and keep a certain amount of money in my bank account, like at least $700 in my checking account, just because I like to go to concerts. Those are kind of big purchases that I make, and concerts come up more unexpectedly, so I try and have enough money that if I want to buy something big, I can use it on that,” Park said.

Although Park keeps a reasonable sum in her bank account, she is one of many teens who struggle with saving when it comes to online shopping. Social media platforms such as Tiktok have normalized overconsumption and are effective in promoting various products to online users. Being able to shop online rather than having to go to the store makes it easier for teens to overspend on these trends.

“Online shopping definitely makes it a lot worse because I feel like there’s just so much more to buy,” Park said. “Because if you go to a store, they only have so much stuff there, but online they have everything that they sell. So it makes it worse because there’s more stuff that I want.”

Peer pressure can also compel teens to overspend. Park said she occasionally struggles with spending when she goes out with her friends.

“I think if I go places and other people are buying stuff, then it makes me not care as much about saving money, so then I’ll buy stuff, too,” Park said. “I don’t want to be the only person to not get something food-wise, so I’ll always get something.”

Peers can not only be a source of pressure to unnecessarily spend money, but also a source of financial stress. Ellis said that fixating on other students’ wealth may also impact an individual’s mental health.

“There is a comparison game, especially when it’s finance. Because some students come from a background of having more money, whereas others don’t; it can definitely be a little bit of a comparison game,” Ellis said.

Additionally, students may experience a sense of guilt when spending, especially for personal desires. Teens can struggle with figuring out where to use their money and may find it easier to spend on others rather than on themselves.

“If a birthday comes around or Christmas comes around, I’ll easily justify spending an amount on someone else,” Canal said. “But if I try to spend that on myself, I’d be like, ‘Oh no, I can’t.’”

Although learning to correctly manage finances can seem difficult, Ellis said that gaining this skill as soon as possible will prove valuable. Financially literate teens will likely be spared from an unfamiliar challenge post-high school of learning how to budget their money.

“I feel like it definitely makes me feel a lot more independent because I don’t have to ask my parents how much is in my account or have them monitoring what I’m buying,” Park said. “I’m kind of glad that I have the ability to now, so I don’t have to be actually an adult, figuring out how to manage and spend my own money.”