As the cost of college tuition rises, high schoolers are looking for ways to offset it. Whether they’re planning to work through college, apply for financial aid and scholarships, take out private loans or get help from family members, most students are stressed about finding a way to pay for higher education.

The 2022 Junior Achievement Teens and Personal Finance Survey found that 69% of high school students’ plans for higher education were impacted by rising educational costs. However, college-related financial insecurity isn’t new.

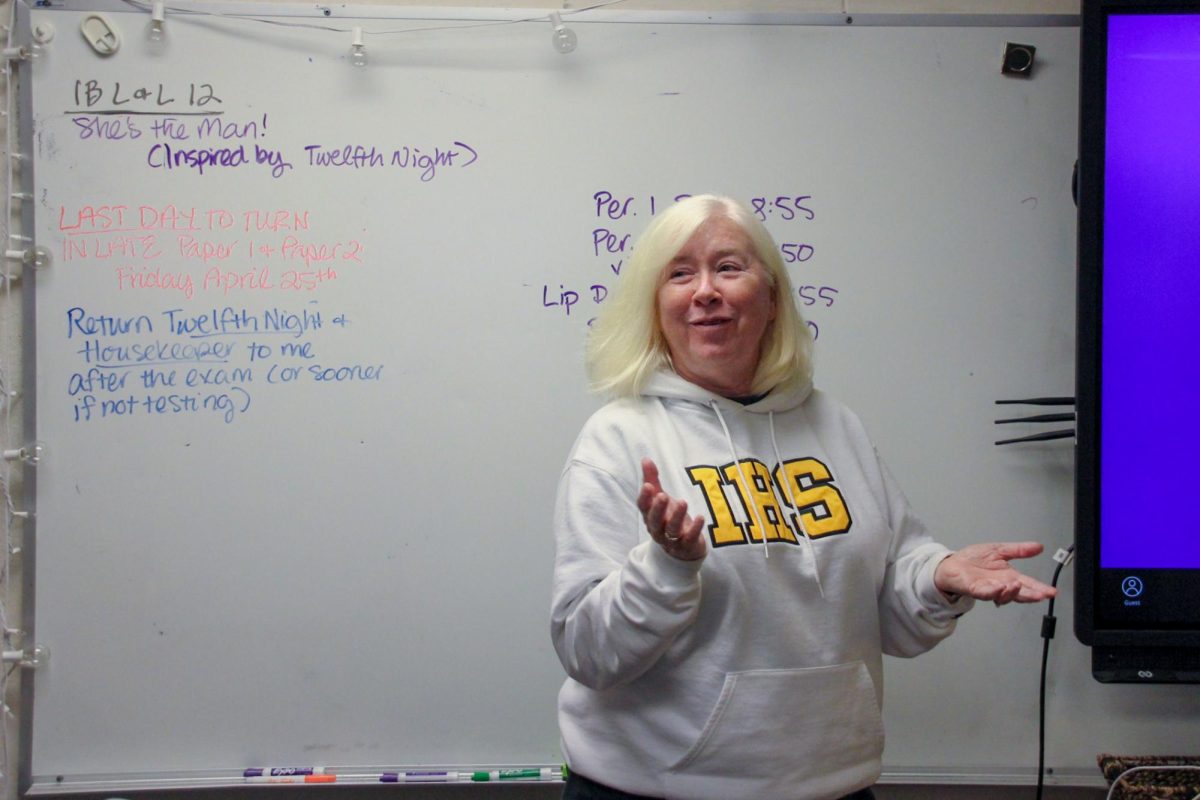

English teacher Omar Omar (he/him) said that although he lived at home with his parents, who paid for three years of his undergrad, he was still stressed about finances when he went to college in the fall of 2012.

“I saved up a lot of money during those three years, and I paid for my last year of undergrad by myself. For my grad experience, [which was] two years at UW Bothell, I got scholarships,” said Omar. “I applied to 20-30 scholarships and I wouldn’t know I received the scholarship until a couple of days before tuition was due.”

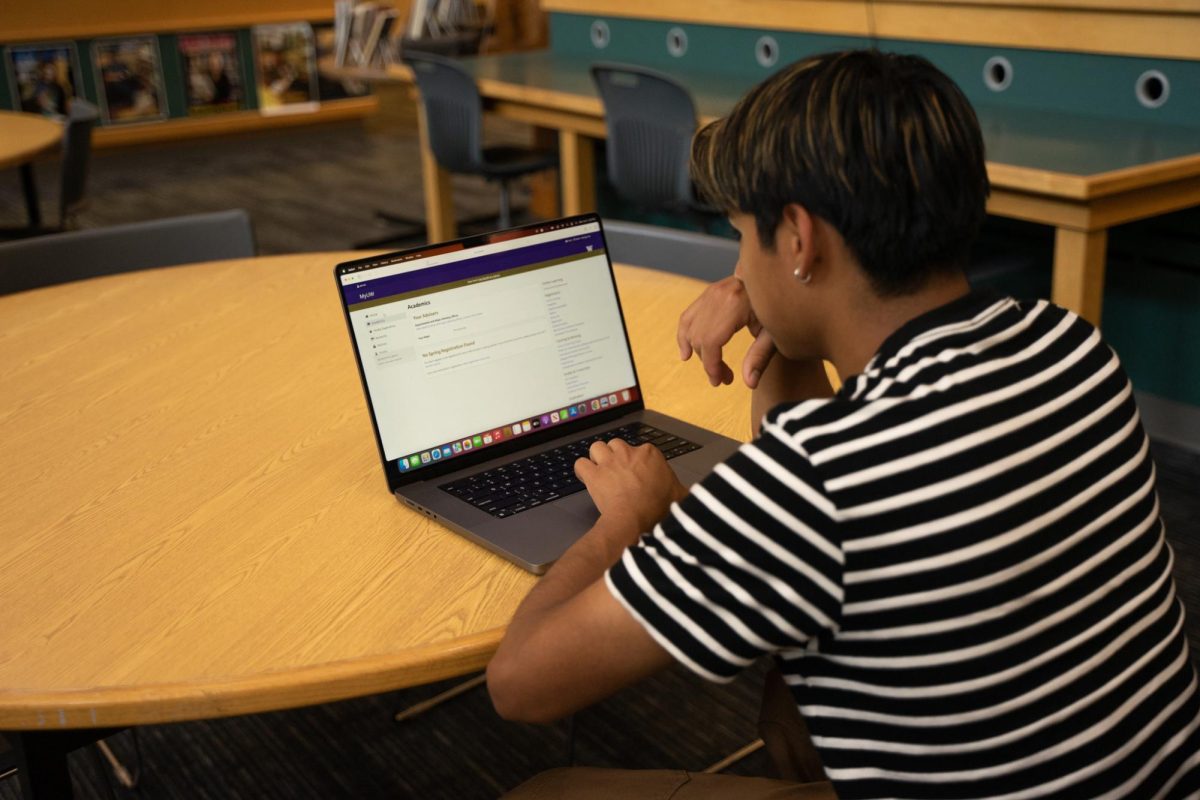

One way to minimize the stress around paying college tuition is by applying for the FAFSA, the Free Application for Federal Student Aid. According to the U.S. Department of Education, more than 90,000 Washington state residents applied for financial aid through the FAFSA in October 2021. However, the FAFSA grants federal aid based on parental incomes, so it wrongfully assumes all parents are helping their children pay for college. This presumption prevents some seniors from receiving financial aid.

Senior Kelli Dillender (she/her) said her parents aren’t paying her tuition for several reasons. She said they want her and her three siblings to learn to become more financially independent, and that, although they are financially comfortable, they would have to sell their cars to be able to pay all of their children’s tuition.

“After I filled out FAFSA, they were like, ‘We estimated this is how much your parents should be giving you,’ and I was like, ‘They’re giving me a plane ticket,’” said Dillender.

She said she was dissuaded from applying to schools with high tuition prices because she would be paying herself. Washington State University regional admissions counselor Robert Stolzberg (he/him) said this is a common problem among high school students.

“I was talking to a student who said, ‘My least favorite part about trying to pick a college is that they’re all so expensive,’” said Stolzberg. “I ended up talking to the student about [how] maybe it’s a good idea to first attend his local community college to get his associate’s degree, which is the equivalent of the first two years at a four-year university like WSU, and that ends up being a much cheaper way to eventually get a bachelor’s degree.”

Students who graduate high school with their associate’s degrees through the Running Start program can use the credits to reduce the cost of a four-year degree. The Running Start program enables high school students to take college courses at community colleges or technical schools without paying tuition. Students who participate earn both high school and college credits through the program.

Senior Sam Otis (they/them) is planning to use their associate’s to minimize the cost of their bachelor’s. They said they’re grateful their parents have some money saved for them but that finding scholarships to pay for the rest of their higher education is mainly up to them.

“It’s a balanced game of college homework, high school homework, scholarships, applying to college and then also just maintaining my own mental health,” Otis said. “I currently do work as a Taekwondo instructor and also as a referee. Both of them are just side money but also being put towards a college fund.”

Students taking AP, IB, or College in High School courses can also earn college credits. Both the AP and IB programs require students to take standardized tests at the end of the school year to earn credits, but College in High School courses do not.

However, there are still other paths students can take. IB coordinator and history teacher Amy Monaghan (she/her) said that some good alternatives to going directly into a four-year degree include — but are not limited to — community college and trade school. However, she also said that students shouldn’t have to look for alternate pathways when pursuing higher education because of financial constraints, especially if they already know what they want to study.

“I think schools need to think about what their missions are,” Monaghan said. “And their mission should be to educate as many students as possible.”